oregon tax payment voucher

Form OR-706-DISC Request for Discharge from Personal Liability and instructions. Oregon Department of Revenue PO Box 14950 Salem OR 97309-0950.

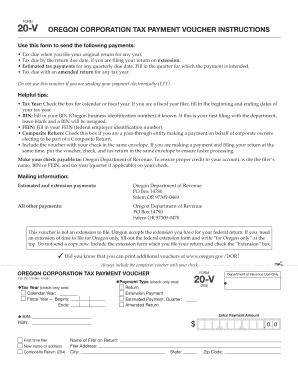

Fillable Online Oregon Corporation Tax Payment Voucher Instructions Fax Email Print Pdffiller

Oregon Corporate Activity Tax Payment Voucher Page 1 of 1 Oregon Department of Revenue Use UPPERCASE letters.

. Form OR-41-V Oregon Fiduciary Income Tax Payment Voucher Instructions. Clean Energy Surcharge CES Forms. Write Form OR-20-V the filers name federal employer identification number FEIN the tax year beginning and ending dates and a daytime phone on your payment.

Estimated payments extension payments. Use this voucher only if you are making a payment without a return. Refunds and zero balance CAT Tax.

On your check or money order write the following. A typed drawn or uploaded signature. Mail the payment and voucher to.

We will update this page with a new version of the form for 2023 as soon as it is made available by the Oregon government. Mail the completed voucher with payment on or before the payment due date to. Write Form OR-19-V your daytime phone the entitys federal employer identi- fication number FEIN and the tax year on the payment.

In May 2020 voters in greater Portland approved Measure 26-210 to help end homelessness across the greater Portland region. Do not staple payment to voucher. Check one of the payment types that describe your statewide transit tax payment.

You can print other Oregon tax forms here. Form 20-V is an Oregon Corporate Income Tax form. Mail your voucher with your payment to.

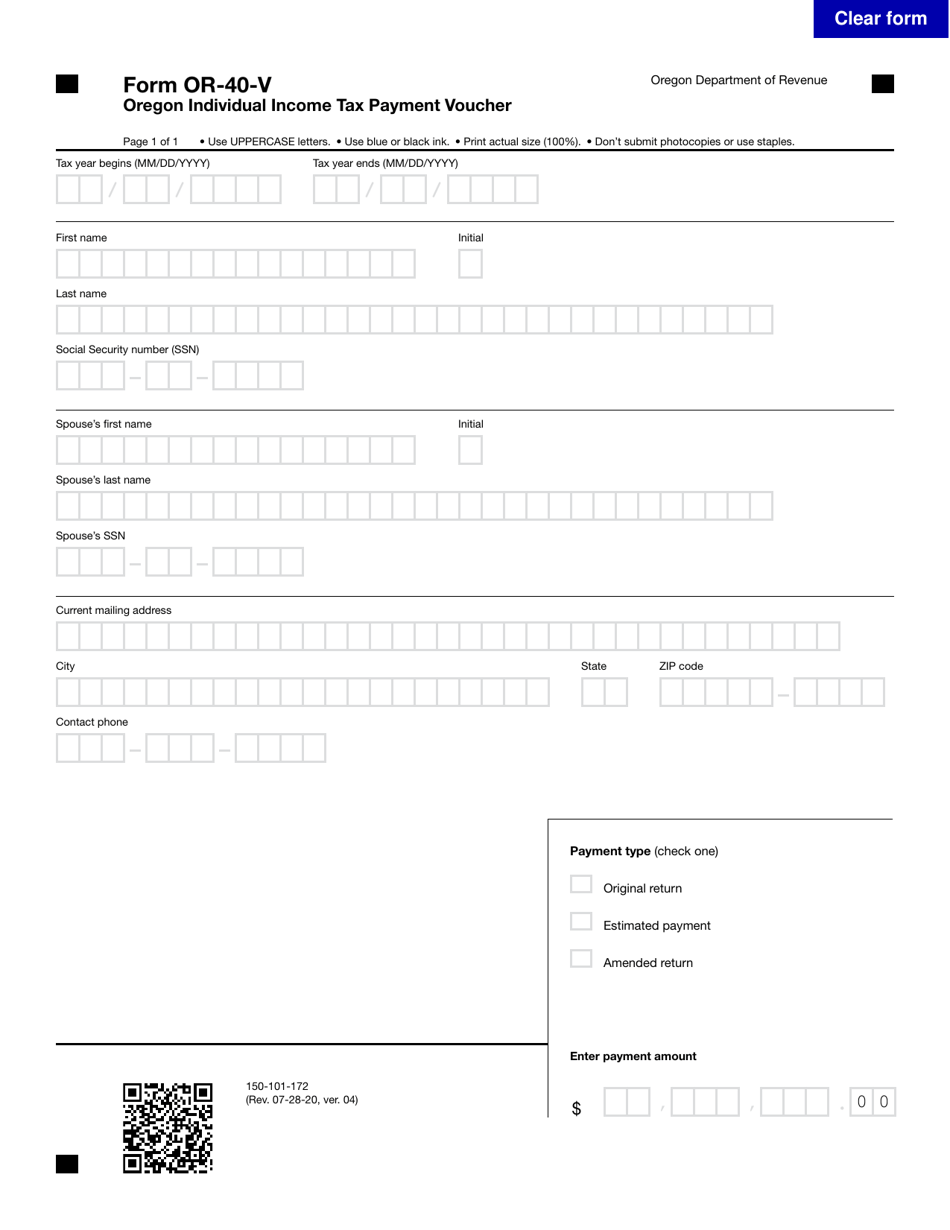

Daytime phone number. Create your signature and click Ok. Print actual size 100.

Residential Rental Registration RRR Forms. 2018 PortlandMultnomah County Combined Business Tax Returns. 2 Oregon Tax Forms 2021 Printable State Form Or 40 And Form Or 40 Instructions Fillable Online Oregon Form 20 V Oregon Corporation Tax Payment Voucher Oregon Gov.

02 Payments by mail. Other Oregon Individual Income Tax Forms. Form OR-706 Oregon Estate Transfer Tax Return Instructions.

Write Form OR-20-V the filers name federal employer identification number FEIN the tax year beginning and ending dates and a daytime phone on your payment. Transient Lodgings Tax Administration Forms. On your check or money order write the following.

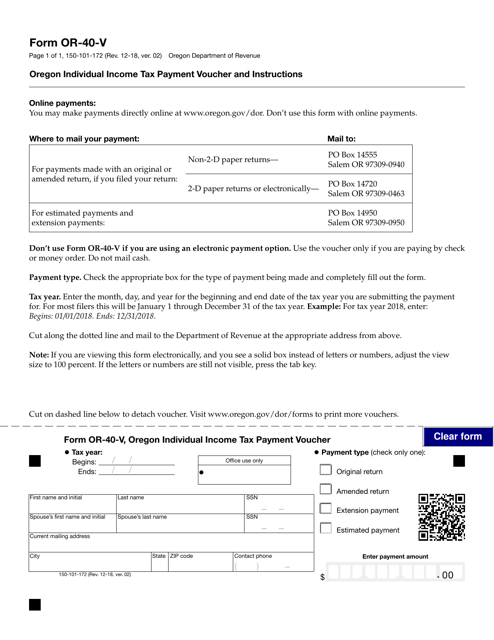

Estimated payment Extension payment Amended return Original return Cut on dashed line below to detach voucher. Ad Fill Sign Email OR OR-65-V More Fillable Forms Register and Subscribe Now. Withholding Income Tax Returns.

You can download or print current or past-year PDFs of Form 40-V directly from TaxFormFinder. For estimated payments and extension payments. Submit your application by going to Revenue Online and clicking on Apply for ACH credit under Tools.

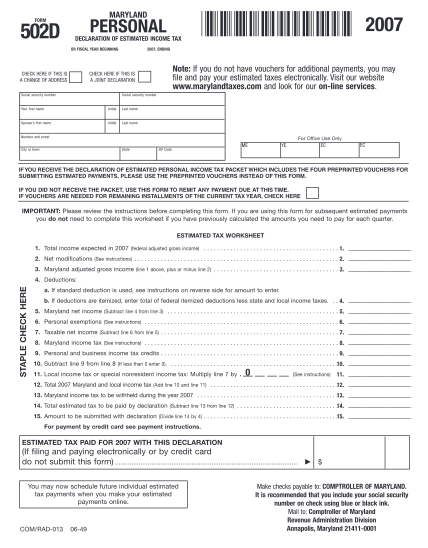

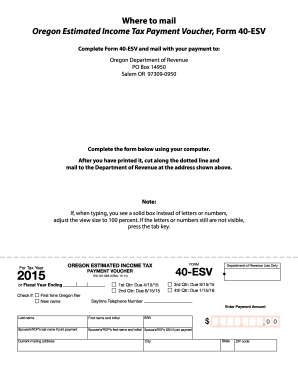

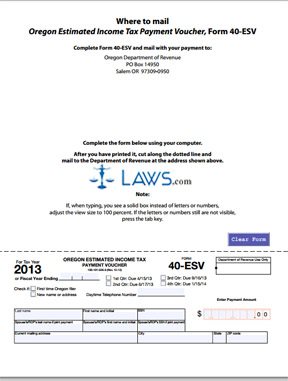

You can download or print current or past-year PDFs of Form 40-ESV directly from TaxFormFinder. Oregon Department of Revenue PO Box 14950 Salem OR 97309-0950. This form is for income earned in tax year 2021 with tax returns due in April 2022.

Form OR706 Oregon Estate Transfer Tax Return. Follow the step-by-step instructions below to design your oregon estimated tax voucher. Do not staple payment to voucher.

Select the document you want to sign and click Upload. Do not mail cash. Pass-through Entity Elective Tax Payment Voucher Page 1 of 1 Oregon Department of Revenue Use UPPERCASE letters.

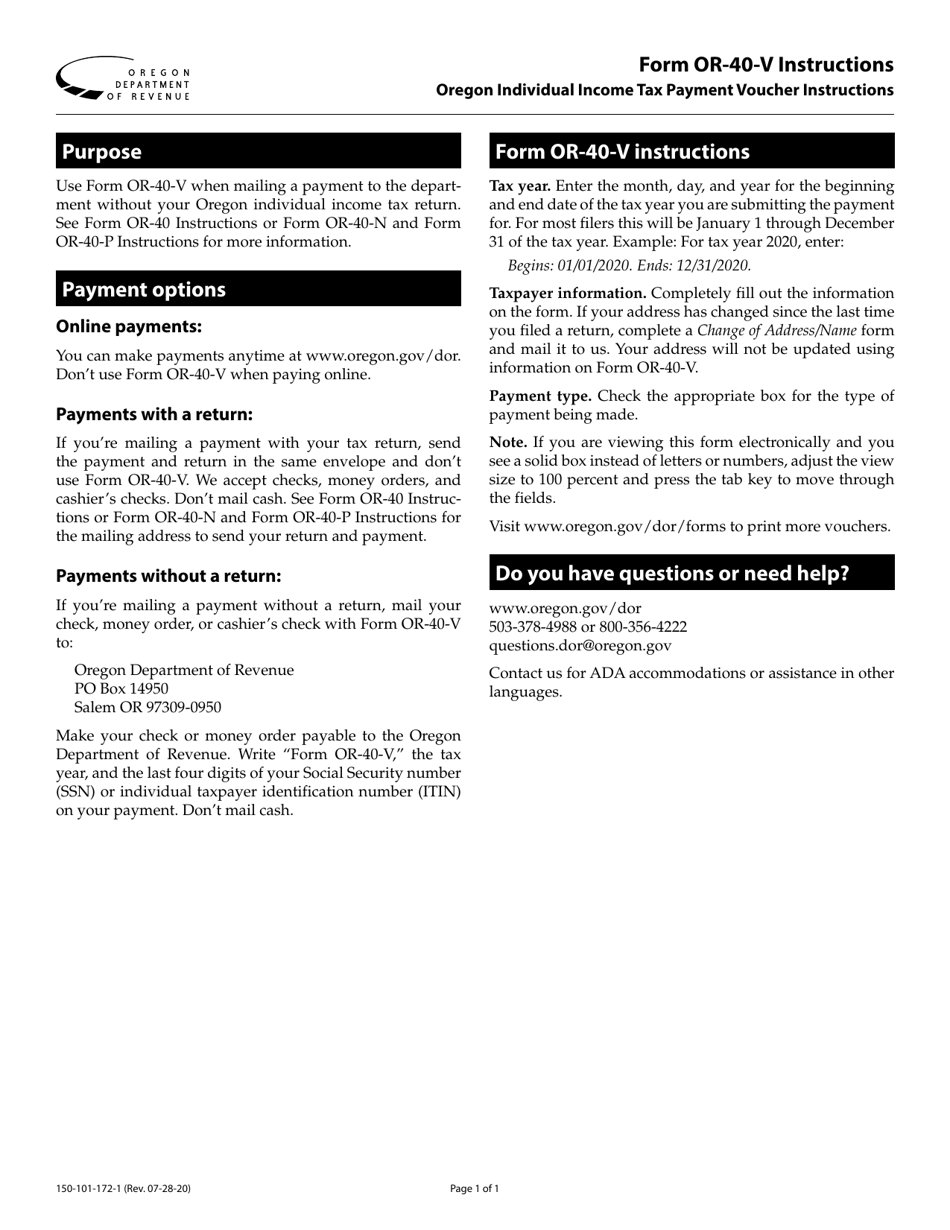

Submit voucher with payment Make check payable to Oregon Department of Revenue. Form OR-40-V Oregon Individual Income Tax Payment Voucher Begins. Use the voucher only if you are paying by check or money order.

Oregon Marijuana Tax Monthly Payment Voucher and Instructions Page 1 of 1 150-610-172 Rev. Form OR-OTC-V Oregon Combined Payroll Tax Payment Voucher 150-211-053 Author. Check the appropriate box for the type of payment being made and completely fill out the form.

Use blue or black ink. PO Box 14950 Salem OR 97309-0950 Dont use Form OR-40-V if you are using an electronic payment option. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities and are used by the revenue department to record the purpose of the check and the SSNEIN of the taxpayer who sent it.

We last updated Oregon Form 40-ESV in January 2022 from the Oregon Department of Revenue. Use this payment voucher to file any payments that you need to make with your Oregon income taxes. Other PortlandMultnomah County Business Tax Forms and Schedules.

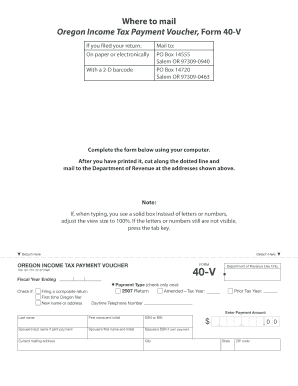

Payment without your tax return mail the payment and voucher to. We last updated the Payment Voucher for Income Tax in January 2022 so this is the latest version of Form 40-V fully updated for tax year 2021. Choose to pay directly from your bank account or by credit card service provider fees may apply.

In May 2020 Portland-area voters approved a new regional supportive housing services program funded by personal and business income taxes. Estimated payment Payment type check one Make your check or money order payable to the Oregon Department of Revenue. Make your check or money order payable to the Oregon Department of Revenue.

Other Oregon Individual Income Tax Forms. Form OR-40-V Oregon Individual Income Tax Payment Voucher Office use only Payment type check only one. Cookies are required to use this site.

Decide on what kind of signature to create. Oregon Department of Revenue PO Box 14630 Salem OR 97309 Oregon Liquor and. Oregon Department of Revenue Created Date.

Heavy Vehicle Use Tax HVT Forms. Form OR-21-V Pass-through. Form OR-CAT-V Oregon Corporate Activity Tax Payment Voucher 150-106-172 Author.

First name Initial Last name Spouses first name Initial Spouses last name. Marijuana account number. Print actual size 100.

Oregon Department of Revenue PO Box 14003 Salem OR 97309-2502 Tobacco and Cigarette Taxes Electronic payment using Revenue Online. Mail the voucher and payment to. Learn who these taxes affect and how to pay.

Your browser appears to have cookies disabled. Make your check money order or cashiers check payable to the Oregon Department of Revenue. Supportive housing services tax.

We last updated the Estimated Income Tax Payment Voucher in January 2022 so this is the latest version of Form 40-ESV fully updated for tax year 2021. Use blue or black ink. Ad Download or Email OR OR-40-V More Fillable Forms Register and Subscribe Now.

Oregon Department of Revenue PO Box 14800 Salem OR 97309-0920. Visit wwworegongovdorforms to print more vouchers. Make your check money order or cashiers check payable to the Oregon Department of Revenue.

Salem OR 97309-0950. There are three variants. Oregon Department of Revenue Created Date.

Pin By Blain Budzeak On City And Town Signs Oregon Life Oregon Outdoors Oregon Travel

17 Payment Voucher Format In Word Download Free To Edit Download Print Cocodoc

Contest On Teacher S Day Teacher Favorite Things Teachers Day Teachers

Form 50 101 172 Or 40 V Download Fillable Pdf Or Fill Online Oregon Individual Income Tax Payment Voucher Oregon Templateroller

Form Or 40 V 150 101 172 Download Fillable Pdf Or Fill Online Oregon Individual Income Tax Payment Voucher Oregon Templateroller

Michigan Girl In An Alabama World Michigan Girl Oregon Girl Kentucky Girl

1957 Vespa Donate Car Donate National Car

Oregon Estimated Tax Payment Voucher 2022 Fill Out And Sign Printable Pdf Template Signnow

Download Instructions For Form Or 40 V 150 101 172 Oregon Individual Income Tax Payment Voucher Pdf Templateroller

Wv140ve Pv State Wv Us Taxrev Forms

Oregon 40 V Payment Voucher Fill Online Printable Fillable Blank Pdffiller

Free Form 40 Esv Estimated Income Tax Payment Voucher Free Legal Forms Laws Com

Individual Income Tax Electronic Payment Voucher

Free Form 40v Payment Voucher For Income Tax Free Legal Forms Laws Com

Oregon 40 V Payment Voucher Fill Online Printable Fillable Blank Pdffiller